You don’t pay for teachers retirement. They have an automatic deduction from their paycheck every month that goes into the teacher retirement fund. So they pay for their own retirement just like you do.

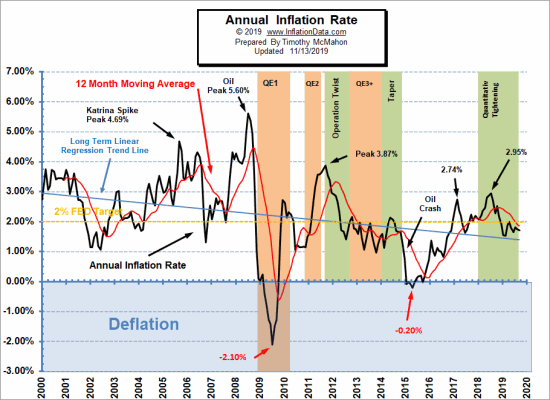

Correct but how is this money invested and at what rate must it grow to cover the DEFINED BENEFIT of the pension plan? Since 2008, what has been the average return for a 10 year treasury? Seven percent, lol surely not. The problem being that most pensions assume a growth rate at a much higher point than is actually attainable. So there's the rub. Most pensions have assumed a higher rate of return on contributions than have actually been attained so we have a shortfall. This is why all retirement plans should be DEFINED CONTRIBUTION as to set the contribution and let reality set the benefit to each individual as the market dictates. Setting a retirement benefit in the form of yearly income based on an average of the last 3 or 5 years of ones employment is not realistic. It's a ponzi scheme that is not attainable, at least not in this economy. In the private sector, "ya get what ya get" as far as the performance of one's own portfolio.

Last edited: